With the stock market doing well and low unemployment levels, why is the general public’s attitude about the economy downbeat? My guess is inflation and shrinkflation (another word for inflation).

Some of my recent experiences on this included a trip to Trader Joe’s. Three items of note struck me:

- Bananas went from $0.19 to $0.29 each – a 52% increase.

- A quart of the store-branded olive oil (with a nifty pour spout) was $8.99 not too long ago – now it is $12.99. This is a 44% increase.

- A bar of lavender soap went from $2.99 to $3.99 – a 34% increase.

In another store, a container of tzatziki sauce went from $2.99 to $3.99, a 34% increase.

In the area of shrinkflation:

- At one time, cartons of ice cream were 2 quarts. Then it went to 1 ¾ quarts. Then 1 ½ quarts. Now I see Turkey Hill cartons at 1.44 quarts. This equates to an overall volume reduction of 28%. The cost did not change.

- At a local supermarket, I used to buy premade refrigerated soups in quart (32 oz) containers. Then, without any warning, the containers were magically reduced to 24 oz—a 25% reduction. The prices were the same. The containers were also mislabeled at 32 oz for a while—I guess the change got ahead of the logistics.

- It’s not just about the numbers, it’s about the feeling of being shortchanged, of getting less for what we pay.

As for gasoline, the chart below is from the “U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon)” from the U.S. Energy Information Administration. This chart shows a 34.3% increase in the cost of gasoline from January 2020 through March 2024. This is even after a demonstrable decline in the cost that peaked at $5.032 in June 2022 (where it was 90.9% higher than January 2020).

Year………. Jan Feb March April May June July Aug Sept Oct Nov Dec

2020 2.636 2.533 2.329 1.938 1.961 2.170 2.272 2.272 2.274 2.248 2.200 2.284

2021 2.420 2.587 2.898 2.948 3.076 3.157 3.231 3.255 3.272 3.384 3.491 3.406

2022 3.413 3.611 4.322 4.213 4.545 5.032 4.668 4.087 3.817 3.935 3.799 3.324

2023 3.445 3.501 3.535 3.711 3.666 3.684 3.712 3.954 3.958 3.742 3.443 3.257

2024 3.197 3.328 3.542

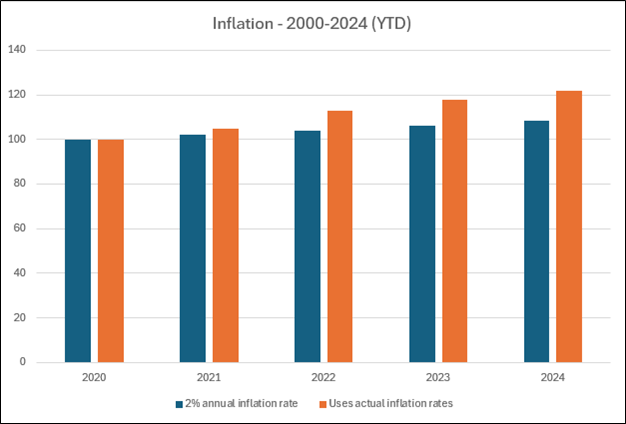

As for inflation – the high rates during the pandemic get baked into the recipe going forward. Using 2000 as the base year, I plotted the pre-pandemic inflation rate of about 2% on a theoretical $100 (blue bar in Figure 1). The orange bar shows the result of the actual inflation rates of:

2021: 4.7%

2022: 8.0%

2023: 4.1%

2024: 3.5% (approximate extrapolation from the results of the 1st quarter).

Even if brought down in subsequent years, the higher rates will always be part of the equation.

So, assuming that the rate was 2%, the total at the end of 2024 would be $108.24. Based on the actual inflation rate, the total will now be $121.83, or more than $13.50, or about 12 ½% higher.

Now it is easier to understand why people are not excited by the economy.

Figure 1